All Categories

Featured

Table of Contents

The internal revenue service may, nonetheless, be needed to get court approval when it comes to insolvency; see 11 U.S.C. 362. An Internal revenue service levy on a primary house have to be approved in writing by a government area court judge or magistrate. See Internal Profits Code sections 6334(a)( 13 )(B) and 6334(e)( 1 ). Section 6334 also provides that specific possessions are exempt to an IRS levy, such as specific putting on clothing, gas, furnishings and home results, certain books and devices of profession of the taxpayer's career, undelivered mail, the portion of wage, salaries, etc, required to support minor children, and particular other assets.

Starting January 1, 2015, the Mississippi Division of Earnings will certainly sign up tax liens for overdue tax obligation financial obligations online on the State Tax Obligation Lien Pc Registry. Tax obligation liens will certainly no longer be recorded with Circuit Clerks. A tax obligation lien recorded on the State Tax Lien Computer system registry covers all property in Mississippi. To stay clear of having a tax obligation lien filed against your building, send the Division of Income complete repayment prior to the due date as stated in your Evaluation Notification.

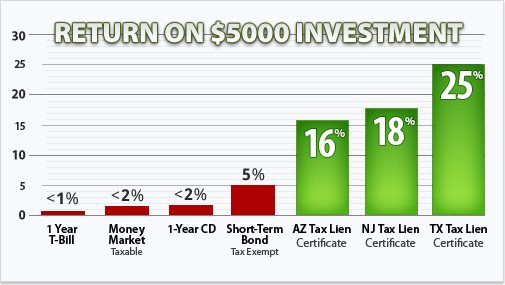

How To Invest In Tax Liens

The State Tax Obligation Lien Computer system registry is a public site available on the web that may be searched by any individual any time. Unlike tax returns, tax liens are a public notice of financial debt. These liens affix to your home and your legal rights to home. When the Division of Income has submitted its notice, details from the lien is offered to the public.

For an individual noted on the State Tax Lien Pc registry, any kind of real or personal residential or commercial property that the individual has or later on obtains in Mississippi undergoes a lien. The lien enlisted on the State Tax Obligation Lien Registry does not identify a particular piece of building to which a lien applies.

Investing In Tax Liens Certificates

Tax obligation liens are detailed on your credit history record and reduced your credit score ranking, which might influence your capacity to get car loans or funding. Mississippi law enables continuations on state liens up until they're paid in complete; so continuations can be submitted repetitively making a tax lien legitimate indefinitely.

The lien consists of the amount of the tax obligation, penalty, and/ or interest at the time of enrollment. Enrollment of the tax obligation lien gives the Division a legal right or passion in an individual's building until the obligation is pleased. The tax obligation lien may attach to real and/or personal residential or commercial property any place located in Mississippi.

The Commissioner of Revenue mails an Assessment Notice to the taxpayer at his last known address. The taxpayer is given 60 days from the mailing date of the Analysis Notification to either totally pay the analysis or to appeal the evaluation - tax lien investment bible. A tax lien is cancelled by the Department when the delinquency is paid completely

Tax Lien Certificates Investing

If the lien is paid by any kind of other ways, after that the lien is terminated within 15 days. When the lien is terminated, the State Tax Lien Registry is updated to mirror that the financial obligation is pleased. A Lien Cancellation Notice is mailed to the taxpayer after the financial debt is paid completely.

Registering or re-enrolling a lien is exempt to administrative allure. If the person thinks the lien was filed in mistake, the person ought to get in touch with the Department of Profits immediately and request that the filing be reviewed for accuracy. The Department of Income may request the taxpayer to submit documentation to support his insurance claim.

Table of Contents

Latest Posts

Houses Up For Sale For Back Taxes

Overage Refund

What Does Tax Lien Investing Mean

More

Latest Posts

Houses Up For Sale For Back Taxes

Overage Refund

What Does Tax Lien Investing Mean